15 Jun 5 Tips for Managing Financial Stress

There’s no doubt that financial stress can feel overwhelming. Fortunately, new research from the 2023 FP Canada™ Financial Stress Index finds that working with a CFP® professional or QAFP® professional can put you on the path toward financial well-being.

By: Kelly Ho, CFP

KEY TAKEAWAYS:

- Four-in-ten Canadians (40%) say money is what tends to cause them the most stress in their lives, more than personal health (23%), relationships (17%) and work (16%).

- One-third (36%) of Canadians are experiencing mental health challenges due to their finances.

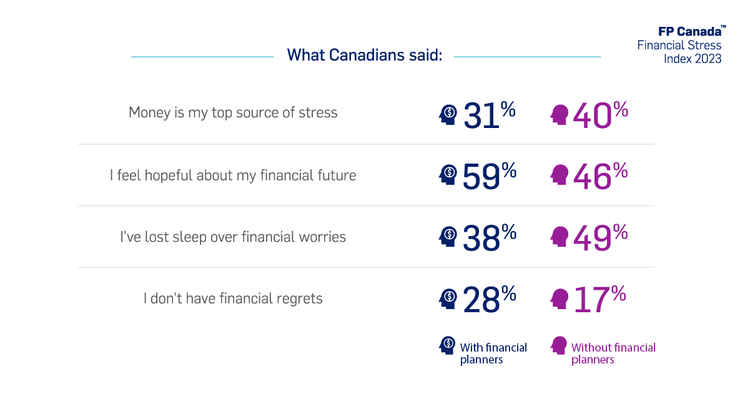

- Canadians who work with a financial planner are less stressed about money, and less likely to have lost sleep over financial worries compared to those who don’t work with a financial planner.

Canadians continue to experience stress related to their finances. In fact, FP Canada’s Financial Stress Index reveals that for the sixth year, money continues to be the top stressor across the country—more than personal health, relationships and work. Unfortunately, money-related stress also leads to issues such as sleep loss (48%), mental health concerns (36%), and relationship problems (16%).

That said, there’s good news for those grappling with financial stress. There’s a simple step you can take to start feeling more in control of your finances. Canadians who work with a financial planner are less likely to say money is the top source of stress in their life (31%) than those who don’t work with a planner (40%).

THE STATE OF FINANCIAL STRESS IN CANADA

According to this year’s Financial Stress Index, various factors are contributing to the financial stress of Canadians, including the following:

- Keeping up with bill payments (35%)

- Saving enough for retirement (35%)

- Saving for a major purchase or expense (32%)

- Debt (29%)

- Job and income instability (22%)

While financial stress can easily seep into various aspects of your life, financial well-being is achievable. Fortunately, you don’t have to work toward it alone!

START MANAGING YOUR FINANCIAL STRESS

These five easy tips can help you mitigate financial stress right now:

1. Understand your household income and spending.

Many Canadians don’t know how much they spend, making credit card bills an unwelcome monthly surprise. Know how much you make and spend so you can find the right balance. There are several financial tracking apps to help you as well as your mobile banking account.

2. Write down your long-term goals.

It’s common to focus on immediate concerns. But thinking about tomorrow—and beyond—can help you change the actions you take today to alleviate future stress. Write down your long-term goals and keep them in mind when making day-to-day spending decisions.

3. Stretch your dollars.

Be creative. Be on the lookout for sales, negotiate deals when you can, buy in bulk, use a price matching app and shop with a list.

4. Have open conversations about money with your family.

It’s important to involve all members of your household in family financial decisions. Have an open discussion with family members and create an environment where it is safe to discuss challenging subjects. From there, you can better understand how much money you have to spend – and share the responsibility of creating a better financial future.

5. Build an emergency fund.

Earmark a small amount every month to cover surprise expenses. Remember: some months may be costlier than others! A good benchmark is to have three months of living expenses stashed in a separate bank account.

A PARTNER IN YOUR CORNER

Taking the first step or the next step toward achieving financial well-being takes courage. Fortunately, speaking with a professional financial planner can help you start to feel more in control.

The bottom line? According to the Financial Stress Index, Canadians who work with a financial planner (like a CFP professional or QAFP professional) were more likely to feel hopeful about their financial future (59%) than those who don’t (46%). Similarly, Canadians who work with a planner are significantly less likely to have lost sleep over financial worries (38%) compared to those who don’t (49%).

Money-related stress can trickle down into other areas of your life. By reducing it, you’re taking a major step toward achieving peace of mind.

To find a CFP professional or QAFP professional who can help you reduce your financial stress, use the Find Your Planner tool.

Read the full article: fpcanada.ca

Published June 15, 2023