19 Jun Money Thoughts – Q2 2024

Federal Budget 2024 Highlights Affecting Canadian Wealth Management

Our government intends to finance its new spending initiatives through increased taxes through the wealthiest Canadians and businesses and government revenues that have exceeded initial projections.

Here are some of the key priorities and potential impact for consideration:

Capital gains inclusion rate adjustment- estimated to generate $19.3 billion within the upcoming five years

- the proposed increase in capital gains inclusion rate is set to increase from 50% to 66.67% for corporations, trusts and individuals

- for individuals – the increase only applies to capital gains exceeding $250,000 annually

- individuals with significant capital gains exposures should be aware of the potential impact on their investment portfolios and estate planning strategies

- tax efficient wealth management tactics such as portfolio rebalancing, tax-loss harvesting, and exploring alternative investment vehicles may help optimize after-tax returns

- those who intend to withdraw from their portfolios in the very near future may want to contemplate realizing a significant portion of gains before June 25

Alternative minimum tax revisions

- AMT underwent significant changes in the 2023 budget with proposed increases in tax rates and a broader scope

- 2024 budget refined these proposals introducing key amendments to impact taxpayers and financial advisors alike

- increase in the claim for the charitable donation tax credit to 80%

- full deductions for certain social benefits such as the Guaranteed Income Supplement and workers’ compensation payments

- full exemption for Employee Ownership Trusts from the AMT

- federal political contribution tax credits and investment tax credits may now be eligible for carry-forward

- extends AMT exemption to certain trusts benefiting Indigenous Groups, reflecting a commitment to equity and inclusivity in tax policy

Lifetime Capital Gains Exemption

- LCGE set to increase to $1.25 million enabling enhanced tax relief to facilitate succession planning, intergenerational wealth transfer and business restructuring endeavors

Home buyer’s plan expansion

- withdrawal limit will be increased from $35,000 to $60,000

- extension of repayment grace period by three years for withdrawals made between Jan 1, 2022 – Dec 31, 2025

By aligning investment decisions with long-term financial objectives and leveraging available government programs, Canadians can navigate proposed 2024 budget items effectively.

Please let us know if you have any questions about your specific situation.

Check out our comments in an interview with CBC here.

Source: Wealth Professional

The information provided is based on current laws, regulations and other rules applicable to Canadian residents. It is accurate to the best of our knowledge as of the date of publication. Current laws, regulations and other rules and their interpretation may change, affecting the accuracy of the information. The information provided is general in nature and should not be relied upon as a substitute for advice in any specific situation. For specific situations, advice should be obtained from the appropriate legal, accounting, tax or other professional advisors. This commentary should not be construed as investment, legal, tax or accounting advice. This material has been prepared as a general source of information only and is not intended as a solicitation to buy or sell specific investments. The tax information provided in this document is general in nature and each client should consult with their own tax advisor, accountant and lawyer before pursuing any strategy described herein as each client’s individual circumstances are unique. We have endeavored to ensure the accuracy of the information provided at the time that it was written, however, should the information in this document be incorrect or incomplete or should the law or its interpretation change after the date of this document, the advice provided may be incorrect or inappropriate. There should be no expectation that the information will be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. We are not responsible for errors contained in this document or to anyone who relies on the information contained in this document. Please consult your own legal and tax advisor.

How to Protect Your Business from Cyberattacks

The recent high-profile ransomware attack on London Drugs highlights an ever-present threat in today’s commercial world. Cyberattacks can halt company-wide operations, cause adverse ripple effects from supply chains down to company staff and even customers, and ultimately cost millions of dollars. Unfortunately, the risk of a cyberattack is only increasing in our digital age. Threats can originate from any email, text, or phone call, with one wrong action leading to a breach.

With this looming threat, the question becomes, “Are you prepared? Fortunately, businesses are not without a defense.

Here are several key strategies to mitigate against the impact of a cyberattack:

- Put together an Incident Response Plan: Develop a practical, easy-to-understand plan covering various scenarios (e.g., ransomware). Regularly practice and test it with all teams, including executives, to identify weaknesses and build familiarity and competencies.

- Purchase Cyber Insurance: Ensure your business has a comprehensive cyber insurance policy that covers a wide range of scenarios. Make sure you meet coverage requirements and maintain documentation of preventive measures.

- Minimize Risks from your Vendors: When it comes to your vendors, include data protection provisions in your contracts, evaluate their security standards, and ensure they have cyber insurance. If possible, conduct annual reviews and audits, requiring your vendors to provide evidence of incident response testing and penetration tests.

- Build a Compliance Team: Find and connect with breach coaches, privacy lawyers, and cyber forensic teams, so that you can promptly retain their services in the event of an incident. Engage industry experts for prevention and crisis management advice.

- Establish a Security Culture: Meaningful action can only come from the top. Implement top-down training on security best practices, phishing threats, and sensitive information protection. Well-informed employees reduce the risk of security incidents. Ensure they know how to report and respond to incidents.

Does this list seem daunting? If so, don’t worry. Start small with what you can do or know how to do. As for the rest, reach out to a professional who can help. Even an earnest conversation with a privacy lawyer or cyber insurance broker is a great starting point.

Still don’t know where to start? Feel free to reach out to us at Interhouse, a new and innovative law firm that provides legal services through its roster of seasoned and skilled former General Counsels and Chief Legal Officers. Come say hi at hello@gointerhouse.com

DLD in the Media

Check out our comments in the following articles and podcasts:

> Highlights from the Federal Budget that could Save You Money

> Higher Cost of Living Keeping Canadians Home

> More Young Adults are Buying Homes with Help from Mom and Dad

DLD Updates

This year, we welcomed our first ever summer student – Tristan Pla!

Tristan completed his first year at the UBC Sauder School of Business and will be with us assisting with special project work until the end of August.

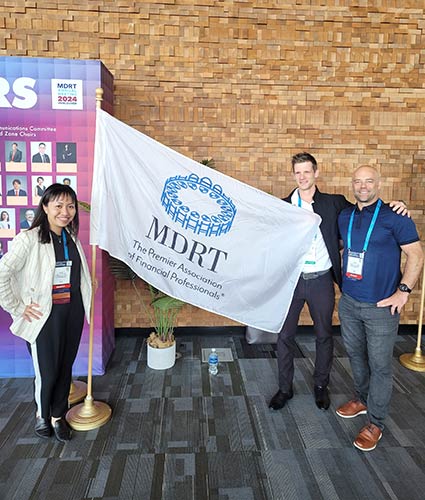

Dave, Kelly and Ryan attended the 2024 Million Dollar Round Table Annual Meeting hosted in Vancouver. There were over 7000 attendees from all over the world. This was Ryan’s first-time attending an annual meeting! There were definitely lots of takeaways that we are excited to implement at our firm.

Please do not hesitate to contact us if you have any questions or if there’s anything we can do to help. Have a great summer!

Warmest regards,

Dave, Kelly, Ryan, Aaron and Brandon

E&OE