11 Oct Money Thoughts – Q3 2024

Economic Webcast – October 2024

In this video, RBC GAM Chief Economist Eric Lascelles shares economic views with timely insights and a global economic outlook.

Key themes include: Inflation easing, Soft landing odds rising, Economic surprises starting to stablize and Inflation pressure continues to ease.

Source: RBC GAM

How do investment fees work?

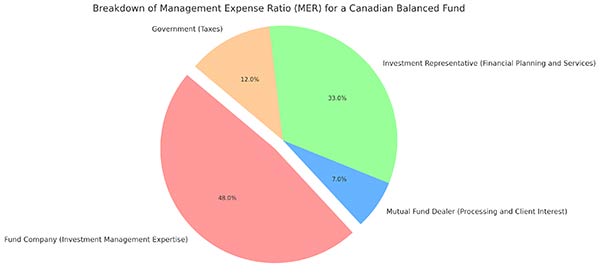

A management expense ratio (MER) is the total* yearly fee you will pay to invest in a typical mutual fund. It’s important to note that you do not pay the MER directly; rather it’s paid by the fund itself.

For example, if you invest $10,000 in a Canadian balanced fund with an MER of 2.0%, the approximate yearly fee would be $200 with about:

- 48% going to the fund company for their team’s investment management expertise, which includes fund research, analysis and insight.

- 7%, on average, going to the mutual fund dealer, which processes your investment purchases and works with your investment representative to keep your best interest front of mind.

- 33%, on average, going to your investment representative for services, including:

- Financial planning and advice, which can help you stay on track

- Adjusting your financial plan as your life evolves

- Helping you create savings habits that can pay off in the long run

- Overhead and operating costs

- 12% going to the government for taxes

*We typically use fee-based fund series so that the advisor’s fee is shown on statements.

Source: CLIML

Realizing the value of the right advice

Making the most of your investable assets starts with the right advice and a sound comprehensive financial plan. Through us, you can have access to a solid planning process, the performance and strength of prominent investment managers and the flexibility to create a plan for the future based on your needs, lifestyle and investment goals.

We will work with you to review your options and provide the right solution to meet your unique needs. Together, we’ll help you realize the value of the right advice.

Contact us if you have questions regarding fees, costs of investing or your investment statement.

Source: CLIML

DLD in the Media

Check out our comments in the following articles and podcasts:

- CBC Radio – Get Rich Quick Schemes are are Legit

- The Vancouver Sun – BC Parents Changing Retirement Plans to Help Adult Children Pay the Bills

- The Cost of Living – Here comes the sun

DLD Updates

Our team has grown again! We’ve grown by one new Associate – Ian Hartmann and two new client coordinators – Joanna Kocylo and Zoey Le. Joanna will be supporting Ryan, Aaron and Brandon. Zoey will be supporting Kelly while Linda gets ready to welcome her first child this year. Ian, Joanna and Zoey all look forward to meeting you!

Ian Hartmann, BBA, CFP – Associate

Joanna Kocylo, BSc. – Client Coordinator

Zoey Le, BSc. – Client Coordinator

In September, we held our annual firm retreat where we had 3 guest presenters speaking on the whole life insurance participating fund investment mandates, Executive Health Benefits and Lending options against whole life insurance. As a team building exercise, we played a game called Oxygen Poker so that we can understand what our needs are.

As a growing team, it is important that everyone remains compassionate and understanding on how to move forward when times get stressful. More importantly, this team building exercise enabled us to understand what feeds our energy and to be able to identify the behaviors that display our vulnerabilities.

Please do not hesitate to contact us if you have any questions or if there’s anything we can do to help.

Thank you for your time and from all of us at DLD – Happy Thanksgiving!

Warmest regards,

Dave, Kelly, Ryan, Aaron, Brandon and Ian

E&OE