18 Sep Money Thoughts – Q3 2023

FHSA (First Home Savings Account)

The tax-free First Home Savings Account provides prospective first time home buyer’s the ability to save up to $40,000 over a 5 year period. Contributions towards the FHSA are tax deductible (like a RRSP) but are tax-free upon withdrawal to purchase a home (like TFSA). The rules around who is eligible for a FHSA is that you must be considered a first time home buyer not having lived in a qualifying home as a principal residence that one owned or owned by spouse or common-law partner.

Ideas on how to best use the FHSA:

1) Immediate home purchase – unlike the RRSP, where deposits have to remain in the account for 90 days prior to withdrawal, FHSAs do not have that requirement. You can withdraw immediately upon deposit. If you don’t have the funds for FHSA and you have more than the required amount for the FHP through RRSP, you can transfer from your RRSP to FHSA on a tax-sheltered basis though there would be no tax deduction but you’re able to access more from your RRSP and not have to repay that portion.

2) Using both the FHSA and RRSP First Time Home Buyer’s Withdrawal – check out this link (advocis.ca/fhsas-beyond-the-basics) for an example of how to use the FHSA, TFSA and RRSP to save for a down payment.

3) Gift to family members – even though you may already be a home owner, you can set up an account for your children / grandchildren (over 18 years old), you can gift $8000 each year for 5 years and the recipients can hold onto the tax deduction for a year where they are in a higher tax bracket

When does one need to close their FHSA?

- The 15th anniversary of opening your firest FHSA or

- You turn 71 years of age, or

- The year following our frist qualifying withdrawl from your FHSA

If you still have an excess balance by the time you need to close your FHSA – a sheltered transfer can be done to move into your RRSP or RRIF without requiring additional RRSP contribution room.

Sources: advocis.ca; canada.ca

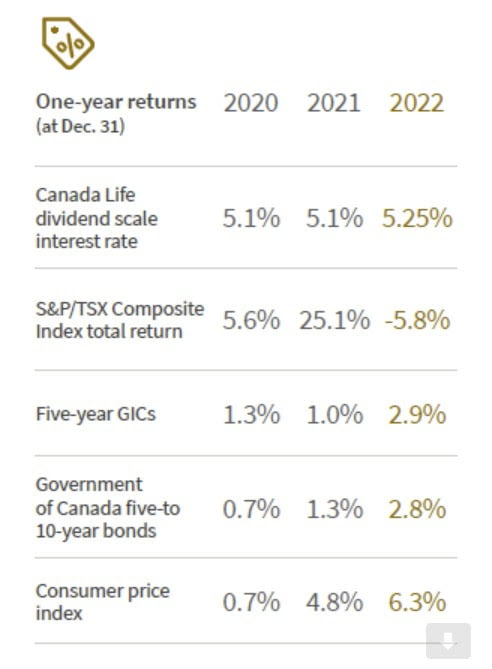

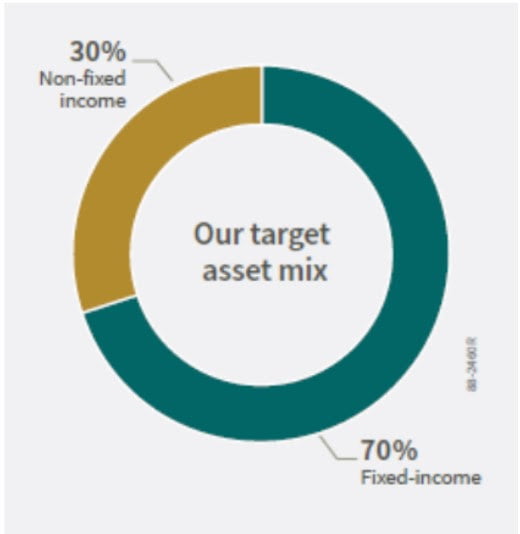

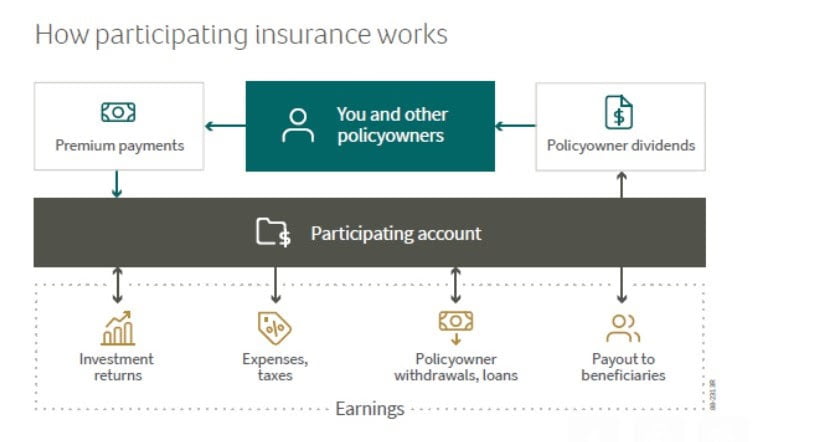

Whole Life Insurance Investment Highlights

- Participating account as of Dec 31, 2022: $50.1 billion

- Consistent one-year returns on dividend scale interest rate as of Dec 31, 2022

Investment strategy:

We thought we would use this opportunity to provide a refresher of the key points of this particular asset in your overall investment and insurance strategy:

As you may know, when appropriate, in addition to its life insurance functions, I incorporate this strategy as a complement to one’s RRSP, TFSA and non-registered as a fixed-income alternative given its unique mandates:

- tax-sheltered growth (especially valuable for those with corporate structures so not passive income)

- guarantees

- vesting (values only go up and not go down)

- liquidity access * (loans from this doesn’t show on your credit report and interest capitalizes so creates more liquidity flexibility and ability to continue receiving dividends)

Lots of flexibility with respect to temporary or permanent policy change options when required and life hits you – contact us to discuss!

E&OE

Source: Canada Life

Northcape Capital

Northcape Capital manages one of our model portfolio Emerging Market fund mandates. This institutional fund manager is based out of Australia and can only be accessed through institutions – not available directly to retail consumers. The objective of the fund is to outperform the benchmark. To learn more about Northcape, please check out their website.

DLD in the Media

Check out the articles, podcasts and television interviews we participated in this summer on topics ranging from interest rates to concert tickets!

- More debt, no problem

- The decision to fix your variable rate mortgage is not an easy one

- 5 tips for managing financial stress

- Concert ticket prices can be outrageous. Here is how to get them for less

- Should you pay for cloud storage?

- Omni Cantonese 2023 Financial Stress index report

- Six things students should know about using financial aid to pay for school

- How ethnic advisors are supporting their diverse mix of clients

DLD Summer Recap

Please do not hesitate to contact us if you have any questions or if there’s anything we can do to help.

Thank you for your time and have a great summer!

Dave, Kelly, Ryan, Aaron and Brandon

E&OE