13 Dec Money Thoughts – Q4 2023

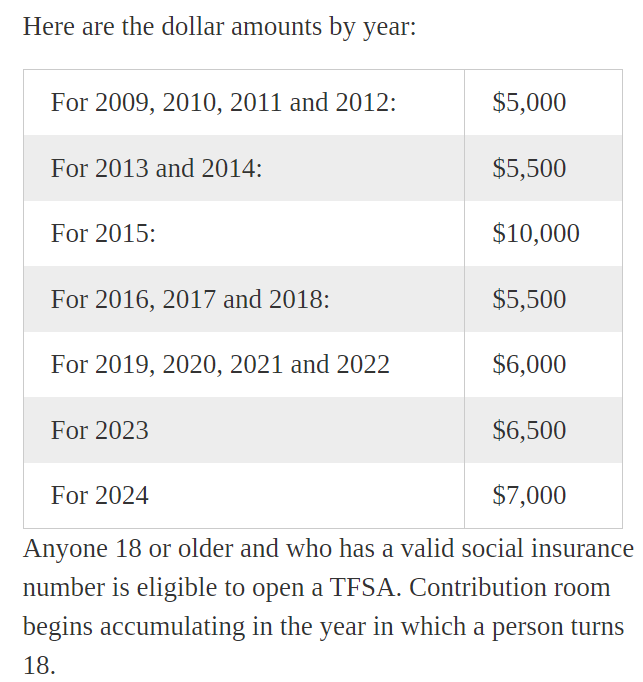

2024 TFSA (Tax-Free Savings Account) and RRSP Contribution Limit

For the second year in a row, the contribution limit for the TFSA has increased by $500 making the 2024 contribution limit $7000. The total contribution room for anyone born before 1991 and never contributed to a TFSA, the new amount is $95,000.

For those of you who have made contributions and withdrawals it’s:

Unused TFSA contribution room to date + total withdrawal made in this year + next year’s TFSA dollar limit = TFSA contribution room at the beginning of next year

Please get in touch with us if you have any questions about the TFSA rules – we know it can be confusing!

The 2024 RRSP contribution limit is $31,560 (up from $30,780 in 2023) or 18% of your income + any unused contribution room from past years minus pension adjustments. The RRSP contribution deadline for the 2023 tax year is February 29, 2024.

Source: Investment Executive and Financial Post

First Home Savings Account (FHSA)

As a refresher, the FHSA is a registered account that allows first time home buyer’s to contribute $8000/year up to $40,000 towards the down payment on a home. Contributions are tax deductible and the account can remain open for a maximum of 15 years. If the funds are not used towards a home purchased, it can be transferred to a RRSP on a tax-sheltered basis without affecting RRSP contribution room.

When we combine this with the RRSP First Time Home Buyer’s Withdrawal of $35,000, it is a total of $75,000 towards a down payment if we’re looking at a home purchase further down the line. Another way one can take advantage of the FHSA is if you have excess RRSPs beyond the amount of $35,000, a tax-sheltered transfer can be done to a FHSA so you’re able to access more of your RRSP towards the down payment.

Lastly, for those of you who have grown children 18 years and older and you’d like to help them out with a future down payment, this is a great way to get a jumpstart. Check out our article from the Q3 Money Thoughts Newsletter on the different ways you can strategize with the FHSA.

If you’re not sure whether the FHSA makes sense for you, please get in touch with us for more information.

E&OE

Registered Education Savings Plan (RESP)

To encourage savings for post-secondary studies, the RESP has some great grant incentives we want to make sure you don’t miss out on. One can contribute $2500/year to receive $500 of federal grants up to a maximum of $7200 over the course of just over 14 years.

In BC, when the child turns 6 years old, there is another $1200 up for grabs – we keep track of this and will reach out when it’s time to apply for the grant. For BC residents, this is a total of $8400 of free money up for grabs.

The lifetime contribution limit towards the RESP is $50,000, which means there is another $14,000 where there are no grants but it is a great opportunity to have some funds grow on a tax-sheltered basis that can be withdrawn at a tax-favourable basis when the funds are needed by your child(ren).

It is important to be mindful about being strategic with contributions especially when trying to catch up because one can only catch up one year at a time in order to receive the full grants.

E&OE

New DLD Office Location – 2024!

After being at 1111 West Georgia since 1999 – we are excited to announce that we will be relocating to 320 Granville Street. More to come on the official move-in date. We are excited to give you a tour the next time you come to see us in-person!

DLD in the Media

It has been an eventful last quarter of 2023 – check out what we’ve been up to!

FACL Gala:

We have been supporters of the Federation of Canadian Lawyers BC since 2016 and at this year’s gala, they broke their attendance record and had their first non-legal keynote speaker – Olympian Patrick Chan!

Hockey Helps the Homeless Vancouver Tournament:

This year, Ryan Stanimir participated in the annual Hockey Helps the Homeless tournament on behalf of DLD. Ryan got to play alongside former pro Kyle Wellwood – his team won the tournament! More importantly, this event raised over $800,000 to help those most in need.

Texas Instruments Visit – Dallas, Texas:

Dave Drummond had the opportunity to visit the Texas Instruments head office alongside Private Investment Council Value Partners for an investors update meeting along with a tour of their manufacturing facility. It was super cool to learn that over 100 million computer chips per day are produced in their facilities!

Bank of Canada Meeting with Senior Deputy Governor – Carolyn Rogers:

In November we got to receive a live update of the Bank of Canada’s position on the current state of affairs. This event was broadcast on the official BOC Youtube Channel

Please do not hesitate to contact us if you have any questions or if there’s anything we can do to help.

From all of us at DLD, we wish you and your family a warm and joyous holiday season. Thank you for your support in 2023 and we wish you all the best for a healthy and prosperous 2024!

Cheers,

Dave, Kelly, Ryan, Aaron and Brandon

E&OE